What is Plexiglass?

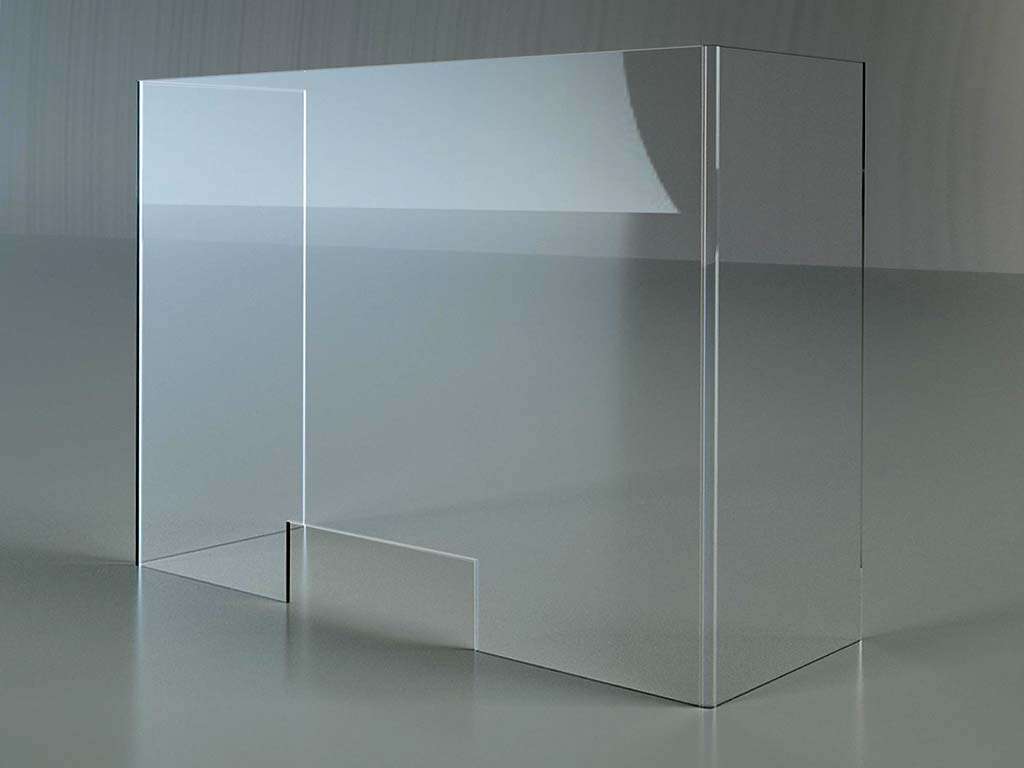

Plexiglass is a light, transparent type of plastic that can be easily moulded into various shapes. It’s used for a wide range of purposes from windows in skyscrapers to kitchen tabletops and beyond.

Plexiglass was originally called Lucite® because it was invented in 1933 by a chemical company called Rohm & Haas located in Philadelphia, PA. Plexiglass was first made available commercially by the Rohm & Haas Company in 1939 where automobile dealers started using it to produce dealer showroom window displays due to its ability .

Investors are becoming increasingly interested in plexiglass stock because of these many applications, including the one with perhaps the largest potential returns – solar energy.

Plastic stocks – Solaal

Various companies manufacture plexiglass including the French company Solaal who have recently raised $4 million.

Solaal’s solar plexiglass is a thin layer of transparent material that can replace silicon sheets used for manufacturing solar panels. Solaal claims its product can increase energy production and decrease costs. The company also says the technology could be the solution to bulky and heavy equipment seen today, as it would allow for both lighter and thinner photovoltaic cells. This would help move the renewables industry forward by increasing transportation ease and decreasing costs of individual solar installations.

Solaal’s product would theoretically result in less semiconductor material being used because the new solar material is both lighter and more efficient than silicon panels. So it could lead to a reduction of weight on our roads, but not necessarily the amount of plastics needed for packaging materials or parts inside PV installations. Even if plastic were completely eliminated from photovoltaic cells, there would still be some need for plastics in all types of equipment involved in the installation process. And with all components installed, these products are bulky enough to require special transportation considerations (it is

Plexiglass Stock Considerations

Plexiglass stocks are also a good investment because:

1. It’s very strong, solid and durable. Some are even bulletproof thanks to the use of high-quality materials. Even after being broken, plexiglass does not shatter into many pieces like glass would which makes it safer for homes with children or pets. Unlike, for example, plywood where you could still see fragments of wood when it is broken, Plexiglas pieces are small enough to be considered safe by occupational safety standards.

2. Plexiglass can be customized depending on how you want it to look. Designs include adding paintings, graphics or logos onto the plexiglass sheet so whatever design you have in mind, it can easily be created by specialists who will cut out the artwork using laser devices

3. Its range of application is likely to increase significantly over the next decade.

Plexiglass stocks are hitting all-time highs in recent times and up 600% since March 2009. It’s very possible this could continue for another year or so before these valuations change, so well worth considering as part of your investment strategy.

If you’re still looking to invest in the plastics industry, plexiglass and other plastic materials, here are some ideas. Obviously these recommendations are for informational purposes only and this does not constitute financial advice.

1. Exxon Mobil Corporation (NYSE:XOM)

Exxon Mobil Corporation (NYSE:XOM) is a global oil and gas company with operations in the US, UK, Russia, Nigeria, Malaysia. It has interests in various exploration projects throughout the world.

Exxon Mobile Corporation manufacture plastic pipes as well as fabricates plastics such as polyethylene and polypropylene.

Exxon Mobile has a market cap of $410.16 billion and about 86,500 employees worldwide.

2. National Oilwell Varco Inc.(NYSE:NOV)

National Oilwell Varco Inc.(NYSE:NOV) are a global leader in the manufacturing and selling of equipment for oil and gas drilling, production, and infrastructure. The company has a global footprint across more than 140 countries with customers in over 150 countries.

The company’s stock jumped by 18% on September 18th due to market speculation that industry spending would increase after the Federal Reserve announced its latest round of economic stimulus measures known as ‘QE3’.

This is a play on increasing worldwide demand for oil with a limited supply available per geographical region causing prices to rise faster than companies can drill new fields or upgrade their existing equipment.

3. Westlake Chemical Corporation (WLKP)

Westlake Chemical Corporation (WLKP) are a multi-national chemical and plastics service provider which, in June 2018, secured a multi-million dollar contract to supply Westlake Ace with its range of carbon fibre fabrics and resin systems. The new agreement has an initial term of five years and will allow ACE customers in the aerospace and automotive sectors to access leading edge engineering technologies from one source.

A subsidiary company of Fiber Materials Inc, Westlake currently manufactures carbon fibre fabrics for use by both commercial enterprises and defence organisations worldwide. Under the terms of the new agreement, WLKP will operate as ACE’s exclusive supplier of aerospace grade Carbon Fibre Prepregs (CFP) which are used to create bus bar assemblies.

4. LyondellBasell Industries N.V. (NYSE:LYB)

LyondellBasell Industries N.V. (NYSE:LYB) is a large holding company. It’s a publicly traded limited partnership listed on the New York Stock Exchange. LyondellBasell is one of the largest plastics, chemicals and refining companies in the world.

The company has been around since 1924 and it has tens of thousands employees worldwide and hundreds of billions in annual sales. LyondellBasell’s major brands include Air Products and Chemicals, Basell Polyolefins, Basell Refining and Atofina Petrochemicals. The company operates through four main business segments: Performance Plastics, Polymers & Surfactants, Industrial Gases & Feedstocks, Automotive OEM Refinish Additives.

It is a world leader in the production of polypropylene, C4 Olefins (through the propylene oxide-based Acetyls process), Linear Low Density Polyethylene (LLDPE) and High Density Polyethylene (HDPE). LyondellBasell’s is also a world leader in producing high quality carbon black.

LyondellBasell products are used in an enormous variety of applications: packaging, footwear, automotive parts and components, home appliances and electronics, construction materials and sports and recreation equipment.

The company has more than 20 manufacturing facilities with a total annual ethylene capacity of approximately 6.5 billion pounds located strategically throughout the US, Europe and the Middle East.

5. Berry Global Group

Berry Global Group are one of the world’s leading suppliers to the packaging industry. Amongst their product offering are fruit punnets, sold under popular brand names including Nature’s Best and Deli-Fresh . Recently, they have faced criticism over how these products treat migrant workers.

Whilst these cases occurred in 2009 and 2012 respectively, Berry Global Group have refused to take responsibility for them until now. This is surprising, given that they were fined by The Fair Work Ombudsman both times after investigations revealed serious worker mistreatment. It was found that workers were being underpaid significantly, which led to some concerns about their ethical approach to business proactively turning a blind eye.

Since the pandemic, Berry Global Group have focused on products that assist with social aspects of the pandemic – such as protective sheets for commercial application, face shields and more.

Berry Global Group’s ‘Worker Protection Sleeve’ is designed to be worn by factory workers during use of potent chemicals, alluding to the harmful nature of subcontract manufacturing involved in production.

6. Dow Inc (DOW)

Dow Inc manufacture a range of products, including plastics, adhesives and chemicals. Dow Inc has a market cap of $54 billion and is a component of the Dow Jones Industrial Average.

As an industry leader, Dow Inc understands that being green is paramount to remaining competitive in today’s business environment. In accordance with its values, the company has taken steps towards preserving the environment. In 2005, Dow launched its “Go Green” initiative as part of their effort to lower greenhouse gas emissions from their facilities by 15 percent before 2010. The company’s major focus was on reducing energy consumption across all sites worldwide. To follow through with this action, they implemented a number of efficiency projects including power optimization at chemical plants and building automation systems at offices and other commercial buildings..

In an industry coming under consistent scrutiny from environmental activists, these initiatives are important, especially when looking for investments in this industry.

Dow inc pay a dividend of 1.48% and its shares are currently trading at a price of 57.56.

7. Hexpol AB

Hexpol AB are manufacturers of adhesives, coatings and color masterbatches. They have an interesting website with lots of good information about plastic additives. Their work is based on research in polymer science.

Hexpol provides both standard/commodity products as well as special products for specific applications; they are the number one in Europe for some of their product areas, which means they offer products not available elsewhere. Hexpol’s range includes products that cover most of the functional requirements needed to produce plastics with unique properties (e.g., barriers, high temperature stability, rigid & transparent). This is important since most basic polymers do not by themselves possess the desired final properties mainly because of insufficient adhesion between resin and additives or poor surface compatibility due to chemical resistance

Hexpol are listed on the Nasdaq OMX Stockholm stock exchange. Hexpol was first listed on the Nasdaq OMX Stockholm Exchange 1988. The company has since evolved into a global supplier of additives for the plastics industry. Among other things, Hexpol is one of the largest suppliers of specialty polymers to companies within many industries such as packaging (bottles), food & beverage (cans) and automotive (tires).

The Group’s customers are leading international processors of polymer materials who apply additives to improve or modify properties that cannot be achieved by polymer alone.

Hexpol share price is currently 99.24 and has been on a roller coaster ride since the beginning of 2018. Hexpol has a market value of about 3,8 billion SEK and is not listed on any other stock exchange than Stockholm.

Conclusion

Companies that manufacture plexiglass make a good investment because of its high demand and low supply. Hexpol AB aside, they are also reasonably solid companies producing good profits, paying good dividends and plenty of room for future growth.